However, as a result of market volatility in the first quarter and performance of individual funds, the portfolio had diverged from the original weightings. Our Asset Allocation has not changed since inception.

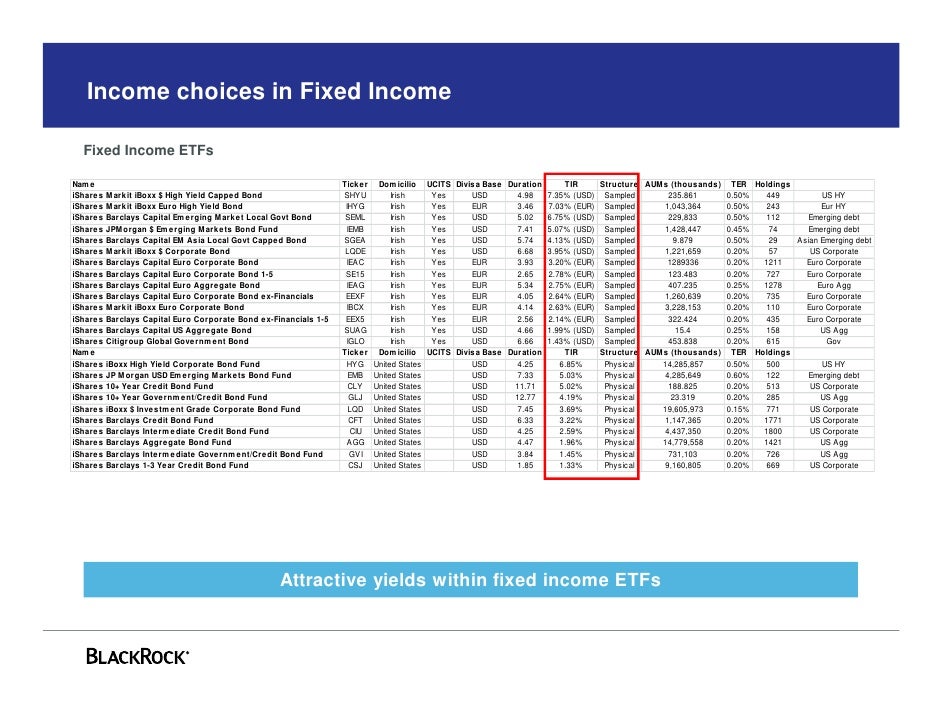

#ISHARE FIXED INCOME FULL#

Increase in the number of funds for greater diversification and a full rebalancing back to the target Asset Allocation and Fund weightings High conviction portfolio of third-party private equity funds selected by Aberdeen Standard Investments. Global exposure to exciting disruptive growth companies, public and private, selected by highly experienced managers at Baillie Gifford. However, as a result of performance of individual funds such as Scottish Mortgage IT, the portfolio had diverged from the original weightings. However, as a result of performance of individual funds, the portfolio had diverged from the original weightings.Ī selective rebalancing back to the target Fund weightings: from Scottish Mortgage IT to Liontrust Special Situations and Jupiter Strategic Bond Funds Replaced with Jupiter UK Special Situations Fund.Ī full rebalancing back to the target Asset Allocation and Fund weightings Reducing Bond exposure and specifically Corporate Bond exposure.Ĭore UK equities portfolio of quality-growth and restructuring/cyclical holdings.Ĭontrarian, value-oriented portfolio of around 40 stocks with a bias to names in the FTSE 350 Index. Multi-asset portfolio targeting downside protection, risk mitigation and inflation protection. Provides passive exposure to a broad and diversified index of US equities, at an attractive fee.

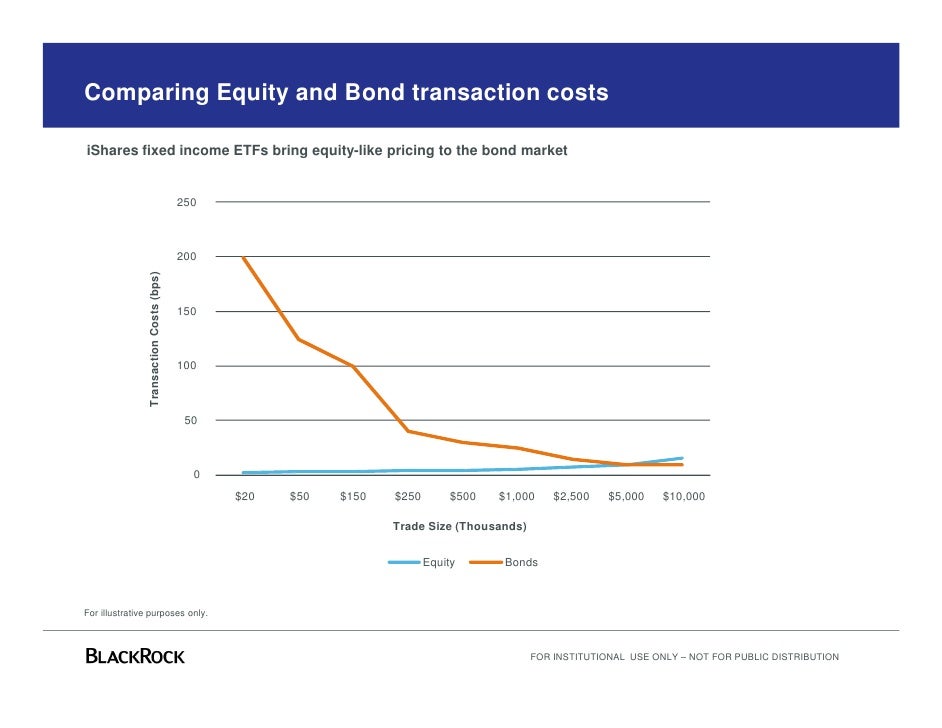

Our Asset Allocation is based on Morningstar’s UK Adventurous Target Allocation Index created by taking an average of the asset class exposures of all the multi-asset funds with similar equity levels as defined by Morningstar’s GBP Allocation 80 + Equity Categoryįollowing the migration to Morningstar's UK Adventurous Target Allocation Index some fund weights have been adjusted and one fund has been removed from the portfolio. For full details on our charges please see our Rates & Charges. Please note that UK Stamp Duty Reserve Tax is not tiered and is charged at 0.5% on Investment Trusts.

#ISHARE FIXED INCOME FREE#

Trade costs are usually £5.99, or £3.99 for our Super Investor Service Plan and free for regular investments. Our monthly fee comes with trading credits. In addition, ii charges a monthly Service Plan fee and a separate SIPP fee. * This is the combined figure for the portfolio, based on the current portfolio weighting.

0 kommentar(er)

0 kommentar(er)